Sustainability

By boosting our risk management as well as sustainability management, our goal is to enhance medium- to long-term corporate value. To this end, we established a Sustainability Committee on November 1, 2022.

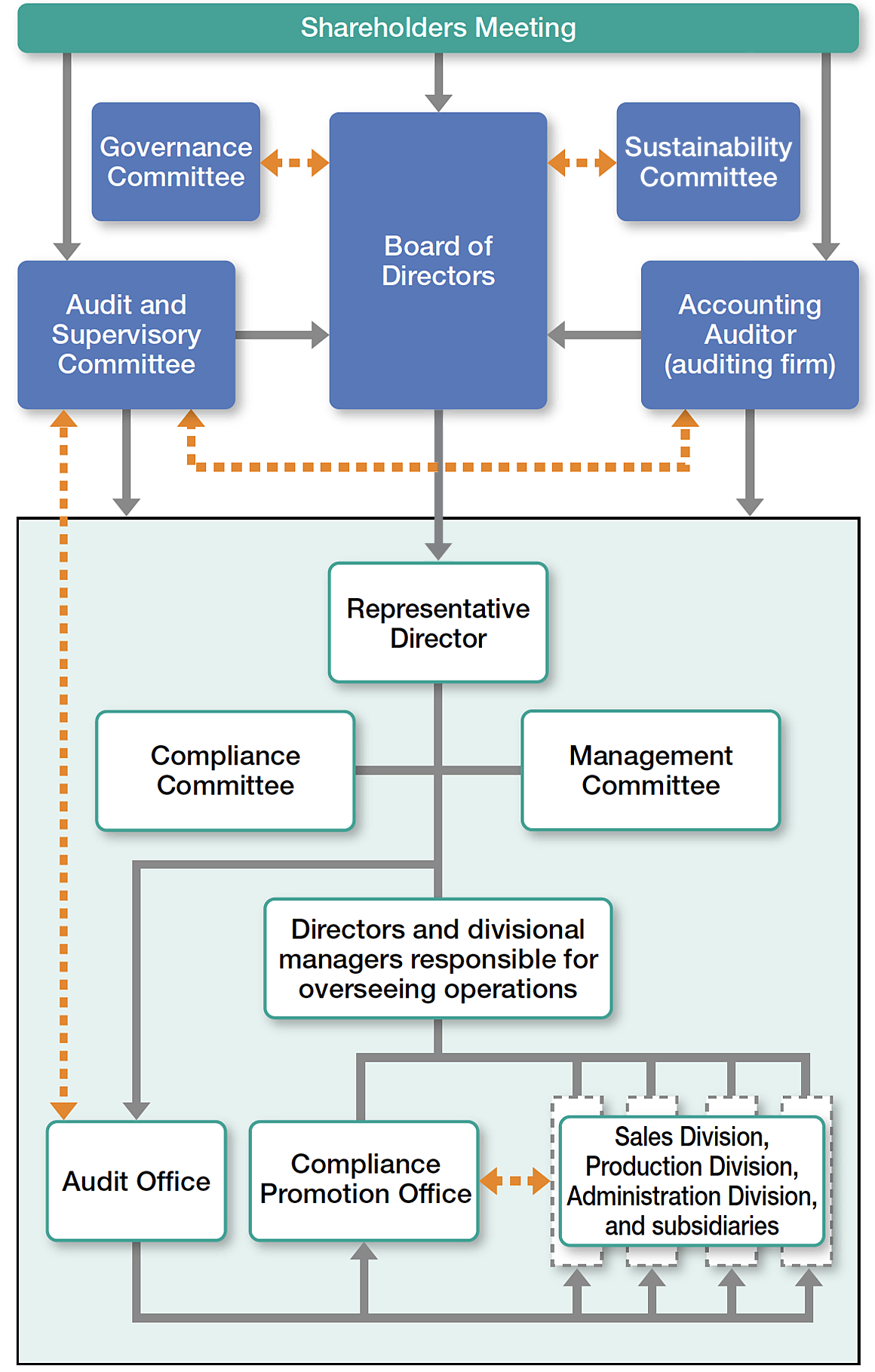

Achilles Corporation is now a company with an Audit and Supervisory Committee. The Board of Directors monitors the implementation status of business operations. In regard to implementation, the Company aims to ensure efficient management by delegating authority to the Directors and divisional managers with responsibility for individual departments.

※The Sustainability Committee was established on November 1, 2022.

The Board of Directors undertakes evaluation and decision-making in relation to the company's basic policy, regulatory requirements, and other important managerial issues including the Group's handling of sustainability issues; the Board also supervises operational implementation status.

To secure a competitive advantage that will boost corporate value, a company must have knowledge backed by real-world experience in the fields of production, sales, technology, and market information (including information about competitors), along with sound business judgment. Also of growing importance are management skills at international business locations and experience in business practice compliance that includes financial accounting, an outlook based on experience outside of the company, and other forms of diversity, plus recently, business judgment from the perspective of ESG.

Taking all of the above into consideration, we discuss the knowledge and expertise that we deem necessary for corporate management and to raise corporate value, and select the appropriate candidates who possess those qualities to be directors.

| Directors (external) | Directors who are the Audit and Supervisory Committee Members (external) | Total (external) | |

|---|---|---|---|

| Male | 10 (2) persons | 3 (1) persons | 13 (3) persons |

| Female | - | 2 (2) persons | 2 (2) persons |

| Total | 10 (2) persons | 5 (3) persons | 15 (5) persons |

To help realize speedy decision-making and operational efficiency, the Management Committee undertakes evaluation of matters entrusted to it by the Board of Directors, and also undertakes evaluation and decision-making in relation to specific implementation strategies based on the policy decided on by the Board and the implementation of other important tasks relating to management.

Each Audit and Supervisory Committee Member follows the auditing policy and division of responsibility laid down by the Committee, supervising and monitoring the Directors' performance of their duties by attending meetings of the Board of Directors, examining circular approval letters and other important documents, visiting business locations (including subsidiaries), etc.

| Directors who are the Audit and Supervisory Committee Members (external) | |

|---|---|

| Male | 3 (1) persons |

| Female | 2 (2) persons |

| Total | 5 (3) persons |

The internal Audit Office verifies compliance status both periodically and as needed. The Audit Office also strives to maintain close liaison with the Audit and Supervisory Committee Members, collaborating with the Audit and Supervisory Committee to ensure effective implementation of auditing operations.

For the Accounting Auditor (external audit), Achilles Corporation has appointed Deloitte Touche Tohmatsu LLC to implement auditing. Audit report meetings are held at which the Audit and Supervisory Committee receives a presentation from the Accounting Auditor on the state of audit implementation and the audit implementation results, and at which the Accounting Auditor offers advice regarding issues relating to accounting and internal controls.

The Governance Committee convenes to advise the Board of Directors for the purpose of increasing the independence and objectivity of the Board of Directors’ functions related to nomination and remuneration, etc.

| Directors (external) | Directors who are members of the Audit and Supervisory Committee (external) | Total (external) | |

|---|---|---|---|

| Male | 4 (2) persons | - | 4 (2) persons |

| Female | - | 1 (1) persons | 1 (1) persons |

| Total | 4 (2) persons | 1 (1) persons | 5 (3) persons |

Achilles Corporation has formulated an Internal Controls Basic Policy, which outlines the systems used for ensuring that Directors carry out their duties in compliance with relevant laws and regulations and with the company's Articles of Incorporation, and the system for ensuring that both Achilles Corporation and the business group formed by the Achilles Group and its subsidiaries carry out their business activities appropriately.

In accordance with the Internal Controls Basic Policy, regarding the internal controls relating to the financial statements stipulated by the Financial Instruments and Exchange Act, the preparation and utilization of these internal controls by Achilles Corporation and its consolidated affiliates is assessed, and the assessment results are presented in the Internal Controls Report.

Remuneration for directors, etc., is outlined below. For details, please refer to the company’s financial statement.

| Number(of people) | Annual remuneration limit (million yen) | |

|---|---|---|

| Directors(not external) | 8 | 270 |

| External Directors | 2 | 30 |

| Total | 10 | 300 |

| Fixed remuneration ratio (%) | Performance-based remuneration ratio (%) |

|---|---|

| 30*1 | 70*1 |

| 100 | 0 |

Calculation of performance-based remuneration = (target table*2 × degree of target achievement) × management ability effect coefficient (weight)*3

Note: The above remuneration does not include employee salaries and bonuses when directors (non-external) also serve concurrently as employees.

| Number(of people) | Annual remuneration limit (million yen) | |

|---|---|---|

| The Audit and Supervisory Committee Members | 5 | 70 |

| Fixed remuneration ratio (%) | Performance-based remuneration ratio (%) |

|---|---|

| 100 | 0 |