Sustainability

The Achilles Group recognizes that environmental response, including climate change, is one of the most important management issues, and is working to resolve these issues through its own businesses.

In April 2023, we announced our endorsement of the TCFD (Task Force on Climate-related Financial Disclosures)* and are working to expand disclosure based on TCFD recommendations, as appropriate.

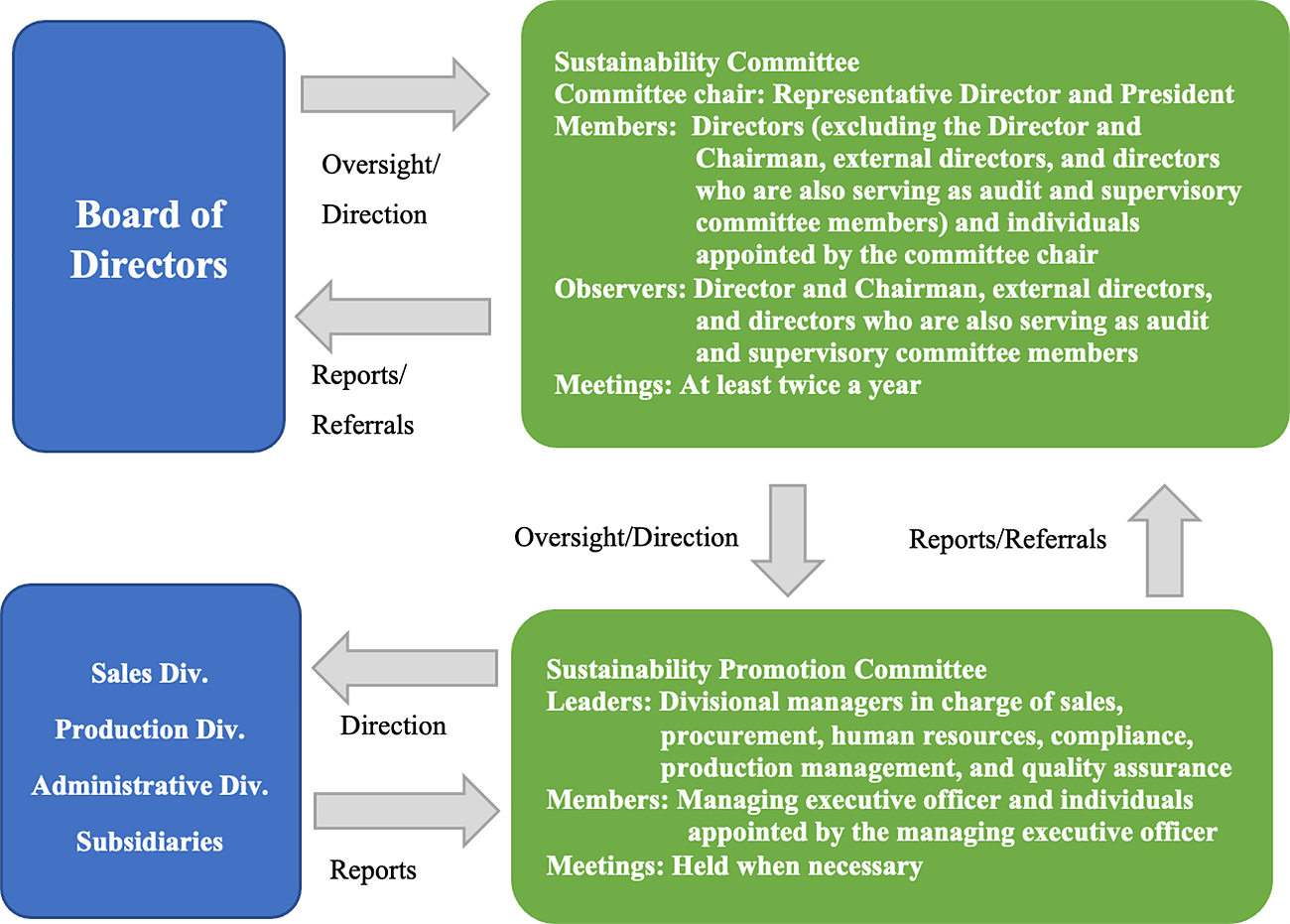

Achilles Corporation considers sustainability issues, which include climate-related issues, to be among our most important management issues and are therefore overseen by the Board of Directors. The Sustainability Committee issues reports to the Board on sustainability issues at least twice a year, which include climate-related information. The Board reviews the status of ongoing initiatives, provides direction, and makes important decisions.

The Sustainability Committee is chaired by the Representative Director; its members consist of individuals appointed by the committee chair along with directors, excluding those who provide advice as observers (the Director and Chairman, external directors, and directors who are also serving as audit and supervisory committee members). Discussions may also be held with outside experts as necessary. The Sustainability Committee deliberates on many issues related to the Group’s sustainability—the formulation of policies, targets, and measures, as well as the identification of material issues, management of progress toward targets, and methods of information disclosure. It also reviews the status of initiatives and issues reports to the Board of Directors.

The Sustainability Promotion Committee is comprised of a managing executive officer and individuals appointed by the managing executive officer, and is led by the divisional managers in charge of sales, procurement, human resources, compliance, production management, and quality assurance.

The Sustainability Promotion Committee is responsible for analyzing and assessing risk and opportunity with regard to sustainability issues, including climate-related issues. It identifies issues that need to be addressed and opportunities to be pursued. Each divisional manager is responsible for handling the identified items within their own division.

The Sustainability Promotion Committee presents its reports to the Sustainability Committee covering the results of their risk/opportunity analyses and assessments, as well as measures taken and progress made.

The Sustainability Promotion Committee analyzes and assesses risks and opportunities with regard to sustainability issues, including climate-related issues, in line with the policies outlined by the Sustainability Committee.

It conducts qualitative and quantitative analyses and assessments using widely disclosed scenarios to evaluate the risks and opportunities of climate-related events that may affect our business. It identifies the most financially consequential events, reporting them to the Sustainability Committee, where they are discussed and a report is created for the Board of Directors.

The Sustainability Promotion Committee summarizes the progress in measures to address identified risks and opportunities that have been reported to the Board of Directors, and reports the summary to the Sustainability Committee, which then discusses the contents, provides guidance or advice as necessary, and reports its findings to the Board of Directors.

The Group manages risks related to sustainability issues in the same way as other business risks, with oversight provided by the Board of Directors, thereby ensuring a group-wide integrated approach to risk management. The magnitude of the impact and likelihood of occurrence of the identified risks determine their priority, based on which systematic countermeasures are then taken.

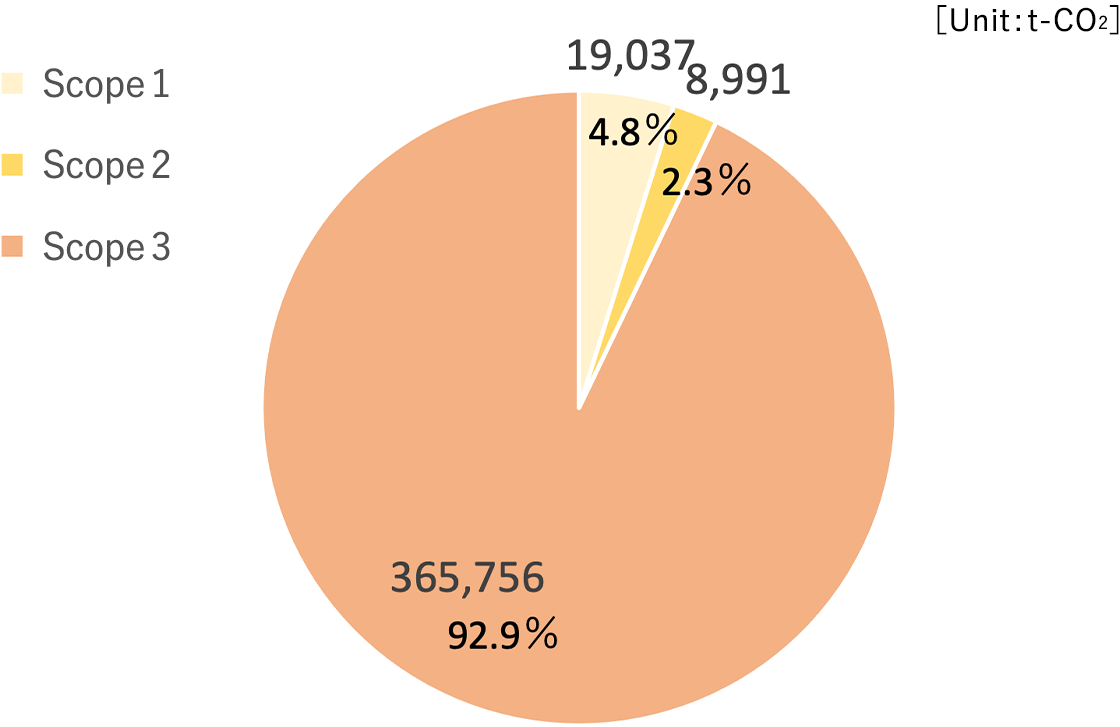

The bulk of the Group’s greenhouse gas emissions derives from energy use (fuel, electricity, etc.), with part attending to product manufacturing. The total amount of GHG emissions (Scope 1 and 2) is set as an indicator; the actual emissions in FY2023 were 34,045t-CO2.

Based on the Japanese government policy “Carbon Neutral 2050,” we have reviewed our efforts to reduce greenhouse gas emission reductions, we have revised our Scope 1 and 2 GHG emissions reduction target from 30% reduction by the end of FY2030 compared to 2018 to 50% reduction by the end of FY2030, and set a new reduction target.

Of the Group's actual greenhouse gas emissions, our non-consolidated Scope 3 emissions in FY2023 were calculated to be 365,756 t-CO2. The calculated values by category are as follows.

| Scope 3 Category | FY2023 Actual(t-CO2) | Reasons for exclusion from calculation, etc. | |

|---|---|---|---|

| 1 | purchased goods and services | 221,789 | |

| 2 | capital goods | 14,908 | |

| 3 | fuel- and energy-related activities | 6,289 | |

| 4 | upstream transportation and distribution | 31,007 | |

| 5 | waste generated in operations | 12,089 | |

| 6 | business travel | 515 | |

| 7 | employee commuting | 1,012 | |

| 8 | upstream leased assets | - | Emissions from leased vehicles subject to the calculation are totaled in Scope 1. |

| 9 | downstream transportation and distribution | 5,065 | |

| 10 | processing of sold products | 515 | |

| 11 | use of sold products | - | Excluded because our products do not emit greenhouse gases when used. |

| 12 | end-of-life treatment of sold products | 72,402 | |

| 13 | downstream leased assets | 164 | |

| 14 | franchises | - | Excluded because the Company does not engage in franchise business. |

| 15 | investments | - | Excluded because the investment business is not the Company's principal business. |

| Total Scope 3 emissions | 365,756 | ||

In order to reduce greenhouse gas emissions, the Minebea Group is working to improve productivity through smart process activities, use of biomass materials, more efficient transportation, and switching to renewable energy sources. In addition to these efforts, we will continue to expand the scope of our emissions calculation and improve the accuracy of our calculations.

We consider climate change to be a medium- to long-term risk and perform scenario analyses to evaluate the resilience of our strategy with regard to climate-related risks and opportunities. We consider the impact of climate change scenarios (from under 2.0 °C to 4 °C) forecast by the International Energy Agency (IEA) and Intergovernmental Panel on Climate Change (IPCC) in light of long-term impact on the company up to the year 2050, based on which countermeasures are formulated.

| Scenario | Primary factor | Change | Category | Assessment | Impact on Achilles | Countermeasures |

|---|---|---|---|---|---|---|

| 1.5℃ | Introduction of carbon pricing | Increased procurement costs | Risk | High |

|

|

| Increased operational costs | Risk | High |

|

|

||

| Increased transportation costs | Risk | Medium |

|

|

||

| Increased stakeholder interest and concern about climate change | Reputational impact of failure to respond | Risk | High* |

|

|

|

| Growing need for ethical products | Opportunity | Medium* |

|

|

||

| Progress in decarbonization | Decline in demand for existing plastics | Risk | High |

|

|

|

| Shift to EVs and progress in DX | Growing need for EV-related products and semiconductor-related products | Opportunity | Medium |

|

|

|

| ZEB/ZEH policy advancement | Growing need for high-insulation products in the residential/building sector | Opportunity | Medium |

|

|

|

| 4℃ | Intensifying weather disasters | Heightened exposure to in the disaster in the supply chain | Risk | Medium |

|

|

| Heightened exposure to disaster at our business sites | Risk | High |

|

|

||

| Growing need for disaster mitigation and recovery measures | Opportunity | Medium |

|

|

||

| More hot days over 30℃ | Increased cooling costs and costs to contend with high temperatures | Risk | Low |

|

|

|

| Growing demand for medical products to address heat stroke and viral infection risks | Opportunity | Medium |

|

|

June 27, 2024